Global Finance Conclave 2024

India’s Resilience Amidst Global Turmoil

Conclave Report– April 04 – 05, 2024

Inaugural Session

Introductory Remarks & Setting The Context Prof. (Dr.) Alok Pandey, Professor and Vice-Dean, Jindal School Of Banking & Finance

Welcome Address Prof. (Dr.) Dayanand Pandey, Professor and Dean, Jindal School Of Banking & Finance

Keynote Address By Chief Guest Prof. (Dr.) Meenakshi Rishi, Howard J. Bosanko Endowed Professor, Albers School of Business, Seattle University, USA

Address By Guest Of Honor Dr. Amarjit Chopra, FCA, Former President ICAI & Member Of Boards At IRDAI, Bank of Baroda & Indian Bank

The Global Financial Conclave held on April 4th commenced with an engaging introductory video showcasing the O.P. Jindal University’s impressive campus and accolades. Following the video, Ms. Rajeevi and Ms. Anusha, took the stage to introduce the esteemed panel, which included distinguished figures such as Prof. (Dr.) Alok Pandey – Professor and Vice Dean at JSBF, Prof. (Dr.) Dayanand Pandey – Professor and Dean at JSBF, and other notable speakers.

Prof. (Dr.) Alok Pandey delivered introductory remarks, providing context on the conference’s focus areas encompassing finance, banking, accounting, and capital markets. He also highlighted significant developments within India’s financial landscape. Notably, he mentioned the prestigious Bloomberg platform and the Jindal Finance Lab, underscoring the university’s commitment to cutting-edge financial education and research. “India’ resilience amidst global turmoil is a lesson for both developed and developing countries. India’s financial system and economic growth have emerged stronger after the Covid19 crisis and we hope to become the strongest and most resilient economies in years to come.” Said Prof. (Dr.) Alok Pandey, Professor And Vice-Dean, Jindal School Of Banking & Finance

Rajeevi introduced the keynote speaker, Professor (Dr.) Meenakshi Rishi, Howard J. Bosanko Endowed Professor, Albers School of Business, Seattle University, USA. Prof. Rishi emphasized her experience and insights into the Indian economy’s growth trajectory. She underscored Mumbai’s prominence as a global billionaire hub, the streamlined patent application process fostering innovation, and India’s ambitious Amrit Kaal Vision 2047. Highlighting India’s economic ascent, she projected India to become the world’s third-largest economy by GDP by 2030. However, she also highlighted persistent challenges such as income poverty, unemployment, and income inequality.

Professor (Dr.) Meenakshi Rishi lauded initiatives like the Pradhan Mantri Jan-Dhan Yojana (PMJDY), driving financial inclusion with over 460 million bank accounts opened, particularly in rural areas and for women. She concluded by stressing the need for sustained efforts to address economic disparities and enhance financial inclusion.

Ms. Rajeevi then introduced the second speaker, Dr. Amarjit Chopra, FCA, Former President ICAI & Member of Boards at IRDAI, Bank of Baroda & Indian Bank, Former Chairman NACAS & Member National Financial Reporting Authority, who commenced with insights into India’s economic landscape, emphasizing its remarkable growth and the proliferation of mobile phones and public institutions like IITs, IIMs, and AIIMS. He paid tribute to Narasimha Rao as an unsung hero of India and discussed the implications of introducing International Financial Reporting Standards (IFRS) in the banking sector. Furthermore, he highlighted the exponential growth in UPI transactions, the burgeoning startup ecosystem, and the importance of corporate governance in evaluating startups. He emphasized the role of regulators in bolstering investor confidence, called for election reforms, and stressed the nexus between ethics and law.

In conclusion, both speakers provided comprehensive perspectives on India’s economic trajectory, highlighting achievements, challenges, and opportunities for growth and reform in the global financial landscape.

SESSION 1 –

Innovations in Banking & Financial Services: A Key Driver for Resilient Economic Growth

- Dr. R.K. Dubey, Former Chairman & Managing Director, Canara Bank

- Prof. Inas Afifah Zahra, Politeknik Negeri Jakarta, Indonesia

- Prof. (Dr.) Hemant Manuj, Professor & Executive Dean, Jindal School of Banking & Finance

Global Financial Conclave commenced with Session 1, focusing on “Innovations in Banking & Financial Services: A Key Driver For Resilient Economic Growth.” Mr. Shashank and Mr. Rudraksh introduced the distinguished panelists, Dr. R.K. Dubey and Prof. Inas Afifah Zahra. Dr. R.K. Dubey, former Chairman & Managing Director of Canara Bank and Executive Director of Central Bank of India, brought his extensive banking experience to the discussion. His tenure at Canara Bank witnessed a remarkable turnaround, emphasizing retail banking, SME banking, and technological advancements. Dr. Dubey’s leadership was instrumental in galvanizing the bank’s staff and boosting business growth, recognized globally through a case study by the Ivey Business School.

Prof. Inas Afifah Zahra, a dedicated Lecturer in Islamic Banking and Finance at Jakarta State Polytechnic, Indonesia, enriched the conversation with her expertise in Islamic economics and finance. With over a decade of experience, Prof. Zahra’s contributions to Islamic finance research, particularly in innovative Sharia-compliant financial instruments, are noteworthy. Currently pursuing her doctoral studies, Prof. Zahra plays a pivotal role in advancing Islamic finance education and mentorship in Indonesia. In her address, Prof. Zahra digged into the realm of Islamic Banking in Indonesia, providing a historical overview and discussing its contemporary landscape. She highlighted the challenges faced during inception, subsequent asset growth, and global rankings. Prof. Zahra emphasized key innovations such as digital transformations and unique financial products offered by Bank Syariah Indonesia.

Dr. RK Dubey then presented innovations within the Indian Banking and Financial Services Industry (BFSI). He underscored customer-centric services, digital transformations, and technological advancements in risk management. Additionally, Dr. Dubey accentuated India’s economic growth, positioning it as the 5th largest economy globally.

Q&A session, facilitated by Prof. Manuj with participation from Prof. Ram and Prof. Alok, ensued, fostering a comprehensive discussion.

Mr. Shashank and Mr. Rudraksh concluded the event by presenting mementos to Prof. (Dr.) Hemant Manuj and Dr. R.K Dubey.

Session 2

Infrastructure Services Growth: Building Resilience & Propelling Growth

Dr. Ajit Shankar, Managing Director & CEO- Ardom Towergen Private Limited

Mr. Amit Chitnis, Vice President, Lean Digital Transformation, Genpact

Prof. Ram B. Ramachandran, Professor and Vice Dean, Jindal School of Banking & Finance

Session 2 of the Global Financial Conclave, titled “Infrastructure Service Growth,” was commenced by Ms. Rajeevi and Mr. Abhay, who invited the panellists onto the stage: Dr. Ajit Shankar, Mr. Amit Chitnis, and Prof. Ram B. Ramachandran.

Prof. Ram set the stage, highlighting the session’s focus on infrastructure services and the digital reformation within this sector, exemplified by innovations such as toll systems like Fast Tag. India’s relatively low adoption of new technology and the challenges in large-scale implementation were discussed.

The panel explored the imbalance in various infrastructure types and the rapid pace of technological advancements, leading to challenges in keeping up. They highlighted issues such as low average revenue per user in mobile subscriptions and the inadequacy of capital infrastructure for mobile networks. The discussion emphasized the need for innovative financial inclusion strategies and public-private partnerships, given India’s burgeoning startup ecosystem. Regarding the development of smart cities, Mr. Chitnis suggested a broader focus on smart grids across multiple cities rather than concentrating solely on select urban centres. The importance of analyzing the use case of innovations was stressed, indicating that solutions must address fundamental problems.

During the Q&A session, the panel addressed topics such as the development of E-SIMs, mobile data access in rural areas, and the role of public-private partnerships in telecommunications. They also explored the ethical implications of the AI revolution, emphasizing responsible rollout and addressing security concerns associated with widespread digital identity usage and AI-driven personalization in social media platforms.

Day 2 – April 05, 2024

Factors Influencing Global Financial Markets

Dr. Dean Diavatopoulos, Dr. Khalil Dibee Endowed Chair in Finance, Albers School of Business and Economics, Seattle University, USA (Online)

Mr. Shashank Shenoy introduces Dr. Dean Diavatopoulus to start the first session of the day. Dr. Dean Diavatopoulus discussed factors influencing global financial markets and begins with a brief description of his research. Financial derivative markets exhibit intense trading activity. Factors such as Historical Volatility, Future Volatility, Option Implied Volatility, Implied Skew, Implied Country Risk, and Implied Probability of a Fed Rate Hike were discussed. He spoke about the implied probability of a fed rate hike for the period of 6 months in 2024. Dean Diavatopoulus discussed the Current US Economic Environment and expects 3 rate cuts this year. He then concluded the session with an open floor for questions.

Questions are raised by Prof. Hemant Manuj, Prof. Alok, Prof. Amlan, and Kevin, covering topics such as the future of Crypto, transformation from gold to crypto ETFs, and choosing between Gold and Real Estate.

Session 3

India’s Capital Markets: Resilience & Innovation

- Mr. Pulock Bhattacharji, Vice President, BSE Institute Ltd.

- Mr. Abhishek Gulia, Vice President, Agility Ventures

- Mr. Sanjay Gakhar, Vice President, Multi Commodity Exchange of India Ltd.

- Mr. Ankit Jain, Sr. Vice President, SBI Capital Markets Limited

- Prof. (Dr.) Soumyadip Roy, Associate Professor and Associate Dean (VITAL), Jindal School of Banking & Finance

Mr. Abishek Gulia discussed venture capital’s role in India’s capital markets, highlighting opportunities for entrepreneurs. Then, Mr. Pulock emphasized the efficiency of Indian stock markets. Followed by, Mr. Gakhar’s perspective on the commodities market, focusing on success metrics like spread and transaction volume.

The panel then discussed challenges faced by individuals in capital markets, including information asymmetry and risk aversion, with inputs from Mr. Ankit and Mr. Abhishek. Mr. Abhishek Gulia also noted the influence of the Indian education system in fostering risk aversion but stresses the need to manage the fear of failure for innovation. Discussions on innovation across different sectors, from commodities exchange to venture capital, led by Mr. Gakhar.

The Q & A session covers topics such as risk management, transaction speed development, bullish sentiment in Indian markets, and purpose of ESG-related stocks, with insights from the VP of the BSE expressing optimism, especially regarding the upcoming elections.

Session 4

Building Entrepreneurial Skills through Education:

Reaping Demographic Dividends

- Prof. (Dr.) Roopinder Oberoi, Senior Fellow, Delhi School of Public Policy &

- Governance, University of Delhi and Professor, Kirori Mal College, University of Delhi.

- Col. Anil Kumar Pokhriyal (Retd.), CEO, Management & Entrepreneurship and

- Professional Skill Council

- Prof. (Dr.) Prashant Sharma, Associate Professor, Jindal School of Banking & Finance

The session was commenced by student volunteer Mr. Abhay, who introduced the panelists: Prof. (Dr.) Roopinder Oberoi, Col. Anil Kumar Pokhriyal, and Prof. (Dr.) Prashant Sharma.

Prof. Roopinder Oberoi initiated the discussion by highlighting the integration of entrepreneurship skills with education, stressing the importance of grounded research, risk-taking, and the transformative nature of failure. She emphasized the need for nurturing entrepreneurship skills within university environments, supported by effective mentorship. The panel then shifted to the concept of social entrepreneurship, delineating its focus on societal concerns alongside profitability, distinct from NGOs. The discussion further explored into government initiatives aimed at leveraging the demographic divide to foster entrepreneurship, followed by an exploration of policies and measures to cultivate the startup ecosystem in India.

Col. Anil Kumar Pokhriyal elaborated on entrepreneurship education initiatives within the CBSE board and stressed the significance of allowing failure from a young age as a fundamental aspect of entrepreneurial growth. Furthermore, the importance of agility and continuous skill upgrading in higher education was emphasized, alongside the necessity of understanding design thinking in entrepreneurship.

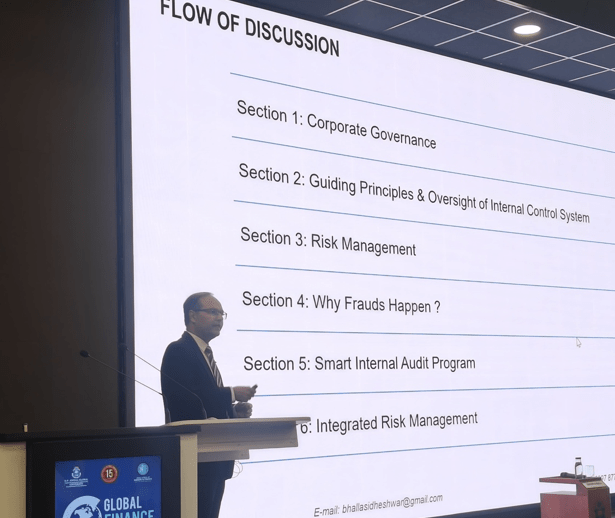

Session 5

Internal Audit & Corporate Governance:

Key for Building a Resilient Corporate Sector

Mr. Sidheshwar Bhalla, FCA, FCS, President, Institute of Internal Auditors, India

Mr. Sidheshwar Bhalla, FCA, FCS, President, Institute of Internal Auditors, India

Corporate governance encompasses mechanisms and processes for corporate control and direction, including the “3 Ps”: people, process, and platform. The speaker i.e., Mr. Sidheshwar Bhalla provided an overview of corporate governance developments in India, addressing the changing regulatory landscape. He discussed the four pillars of compliance: policies and procedures, statutory requirements, governance, operations, and financial reporting. Emphasis was placed on the importance of internal controls, noting common compromises in fraud such as delegation of authority and segregation of duties. Entity-level controls were highlighted as essential, covering areas like business risk management, ethics framework, internal audits, financial integrity, succession planning, and management operational review. Mr. Bhalla outlined how risk management should be conducted, stressing its shared responsibility and demonstration of risk assessment matrices. Environmental, Social, and Governance (ESG) concepts were emphasized, along with case studies of corporate governance failures like Enron, Volkswagen, Lehman Brothers, Uber, and Apple. Reasons behind fraud occurrences, including factors like pressure, were discussed.

Valedictory Session

Conclave Report by Prof. (Dr.) Amlan Das Gupta

Prof. Amlan Das Gupta presented the overview of the proceedings of all the sessions of GFC. He presented the key ideas and discussions initiated by each speaker in their respective session. The report was concluded by Prof. Amlan’s acknowledgement on India’s resilience amidst the global turmoil.

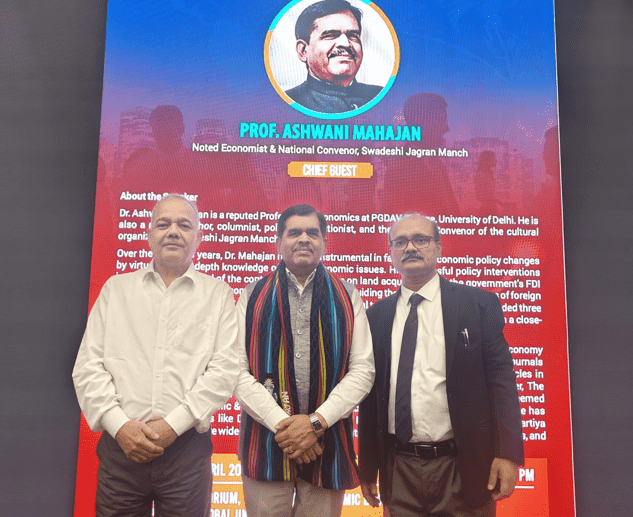

Address By Chief Guest

Prof. Ashwani Mahajan, Noted Economist & National Convenor, Swadeshi Jagran Manch

Prof. Mahajan addressed the house with his remarks on India’s economic resilience throughout history which was testament to its ability to adapt, innovate, and endure in the face of various challenges. He conveyed the factual aspects of India’s ancient civilizations, showcasing early signs of economic resilience through their advanced urban planning, sophisticated trade networks, and agricultural innovations. Despite facing challenges like climate change and external pressures, these civilizations thrived for centuries, demonstrating resilience in sustaining their economies. He further mentioned India’s history is marked by vibrant cultural exchange and innovation, which have been key drivers of economic resilience. From the spread of Indian mathematics and astronomy to the flourishing trade along the Silk Road and Indian Ocean, India’s openness to new ideas and technologies has bolstered its economic strength over time. He later shared his perspective on the rise of innovative entrepreneurship in India has been a driving force behind economic resilience. Startups and small businesses have flourished, leveraging technology and innovation to create new markets and generate employment opportunities, thereby contributing to economic growth and resilience. He also spoke about recent policy reforms aimed at liberalizing and modernizing various sectors of the economy have bolstered India’s resilience. Initiatives such as the Goods and Services Tax (GST), the Insolvency and Bankruptcy Code (IBC), and measures to improve ease of doing business have enhanced the business environment and stimulated investment. He concluded his address by acknowledging that India’s economy continues to exhibit resilience in the face of evolving domestic and global dynamics. By leveraging its diverse economic strengths, promoting innovation and entrepreneurship, implementing effective policy reforms, and addressing key challenges, India can further strengthen its economic resilience and emerge as a global powerhouse in the 21st century.

Prof. Mahajan addressed the house with his remarks on India’s economic resilience throughout history which was testament to its ability to adapt, innovate, and endure in the face of various challenges. He conveyed the factual aspects of India’s ancient civilizations, showcasing early signs of economic resilience through their advanced urban planning, sophisticated trade networks, and agricultural innovations. Despite facing challenges like climate change and external pressures, these civilizations thrived for centuries, demonstrating resilience in sustaining their economies. He further mentioned India’s history is marked by vibrant cultural exchange and innovation, which have been key drivers of economic resilience. From the spread of Indian mathematics and astronomy to the flourishing trade along the Silk Road and Indian Ocean, India’s openness to new ideas and technologies has bolstered its economic strength over time. He later shared his perspective on the rise of innovative entrepreneurship in India has been a driving force behind economic resilience. Startups and small businesses have flourished, leveraging technology and innovation to create new markets and generate employment opportunities, thereby contributing to economic growth and resilience. He also spoke about recent policy reforms aimed at liberalizing and modernizing various sectors of the economy have bolstered India’s resilience. Initiatives such as the Goods and Services Tax (GST), the Insolvency and Bankruptcy Code (IBC), and measures to improve ease of doing business have enhanced the business environment and stimulated investment. He concluded his address by acknowledging that India’s economy continues to exhibit resilience in the face of evolving domestic and global dynamics. By leveraging its diverse economic strengths, promoting innovation and entrepreneurship, implementing effective policy reforms, and addressing key challenges, India can further strengthen its economic resilience and emerge as a global powerhouse in the 21st century.

Vote Of Thanks

Prof. (Dr.) Alok Pandey, Professor And Vice-Dean, Jindal School Of Banking & Finance

Prof. (Dr.) Alok Pandey, Professor And Vice-Dean, Jindal School Of Banking & Finance

The Vote of Thanks was delivered by Prof. (Dr.) Alok Pandey at the conclusion of Global Finance Conclave 2024 on April 05, 2024. The Vote of Thanks served as an expression of gratitude to all the participants, organizers, sponsors, and attendees who contributed to the success of the event. Prof. (Dr.) Alok Pandey began by expressing gratitude to all the participants who attended the event, including distinguished guests, speakers, faculties and student volunteers. He highlighted the significance of their presence and contributions in making the event a memorable and enriching experience. He acknowledged the efforts of the organizing committees, volunteers, and support staff for their dedication, hard work, and meticulous planning in ensuring the smooth execution of the event. He commended their commitment to excellence and professionalism, which played a crucial role in the success of the event.

Disclaimer: Team Campusutra did notcreate or edit this content.