With financial services market growing in leaps and bounds,

young professionals in Finance are in great demand.

There cannot be a better time to opt for a MBA in Finance

Opportunities with MBA Finance as a Specialization, has been on a constant growth path. It has also been one of the most sought after courses and more so, now with many additional avenues opening up in finance, financial services and related industries. Many may associate ‘Finance’ with jobs in the banking sector but in reality banking is only a small sector compared to the huge opportunities lying to be grabbed in the non-banking sector. Much more lucrative offers come from non-banking sectors and financial consulting companies as talented financial analysts are in great demand. Consulting companies such as JP Morgan, Ac Nielsen, Morgan Stanley, Boston Consulting Group, Avendus Capital etc. are consistently in search for talent and trainable resources in this field.

Also Read: FORE School of Management opens applications for PGDM FM for additional 60 seats.

Huge amount of scope lies in the sectors like – Financial Accounting & Planning, Corporate Finance & Governance, Venture Capitalists, Personal Finance, Personal Equity Investments, Capital & Stock markets, Asset Management, PortFolio Management.

Huge amount of scope lies in the sectors like – Financial Accounting & Planning, Corporate Finance & Governance, Venture Capitalists, Personal Finance, Personal Equity Investments, Capital & Stock markets, Asset Management, PortFolio Management.

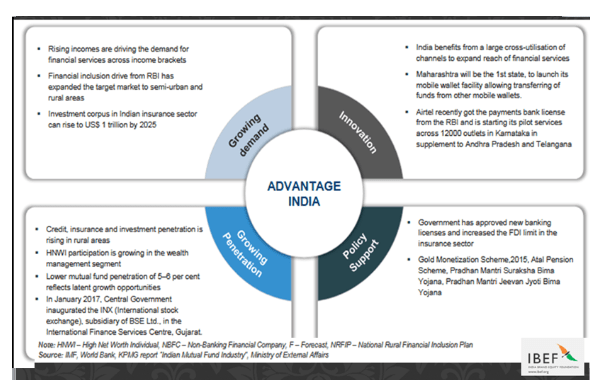

According to reports India is on top of the chart on financial inclusion as around 20 crore people have “gained access” to financial services, with PE investments touching an all-time high and USD 500 mn plus investments.

A common theme across investments has been ‘technology as an enabler’.

E-commerce, start-ups, banking and financial services, real estate, and IT/ITeS continued as top sectors. Technology driven financial organisations or FinTech companies contributed to the growth for this sector. With a host of Fintech companies and other startups in Online financial services, electronic payments and Digital Reimbursement sectors, there are many more avenues where enormous amount of opportunity lies for a MBA in finance.

The financial management technology tools provide greater cost transparency, total cost views of technology, applications and services spend with better budgeting and forecasting.

Corporate Finance and Financial Risk Management recruits the brightest minds from B Schools

Corporations nowadays are facing several systemic and idiosyncratic risks. These risks can arise on account of numerous market forces like volatile interest rates, exchange rates, and commodity prices, or owing to involvement of counter parties in business transactions amongst others. Every corporation has limited capacity to bear risk. When they approach their potential risk-bearing capacity, one risk comes at the cost of another risk. Therefore, risk management has become one of the key career options for management graduates.

There are plenty of job opportunities in Credit Risk Management, Foreign Exchange Risk Management, and Operational Risk Management. Credit Rating agencies like Credit Suisse, Moody’s, S&P, Fitch and CRISIL, insurance companies, consulting companies like KPMG, E&Y are the major recruiters in the arena of risk management.

Opportunities in Investment Banks and Management consulting

Investment banks recruit graduates from premier business schools, who can demonstrate proven skills in financial modeling and business valuation. Functions of investment banks have now become ubiquitous, ranging from fundraising in domestic and international capital markets to deal structuring for mergers and acquisitions. Investment banks support a range of corporate decisions requiring strategic interventions.

Investment Management corporations, which include mutual fund houses, hedge funds, and private equity firms, often deal with secondary market trading of equity, debt, and derivative securities. They manage investment portfolios worth billions of dollars for high net worth individuals, pension and retirement plans for large corporations, and government and pooled public investments.

Management consulting firms recruit graduates for corporate strategy, market opportunities, and financial analysis.

Opportunities beyond the general trend of career path in Finance

Apart from the day-to-day functional applications which we are aware of in any corporation, primarily in cost control, operating budgets, and internal auditing and liquidity management, today corporate finance deals with much more :

Investment Banking & Investment Management

Management Consulting in financial decisions – growth strategy and planning of company’s growth opportunities, capital optimization, dividends and buyback decisions.

Credit Risk Management, Foreign Exchange Risk Management – Operational Risk Management analysed by Credit Rating agencies like Credit Suisse, Moody’s, S&P, Fitch and CRISIL, insurance companies, consulting companies like KPMG, E&Y are the major recruiters in the arena of risk management.

MBA/PGDM in Finance can be an alternative career for Chartered Accountants

Finance specialization has been considered as an alternative by many students who wanted to pursue Chartered Accountancy, Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM).

Popular simulation based financial tools used by B Schools today which give the students a virtual experience of the real market scenario are Thomson Reuters, Bloomberg, Euro Monitor. Simulation and gamification based workshops done by campusutra.com are dedicated to assist students get a real feel of the market place and understand functionalities better and support data backed projects and research.

Some of the popular management schools for recruiters of financial services providers:

- Indian Institute of Management, Ahmedabad

- FMS – Faculty of Management Studies, University of Delhi

- Indian Institute of Management, Bangalore

- XLRI – Xavier Labour Research Institute, Jamshedpur

- Jamnalal Bajaj Institute of Management Studies (JBIMS)

- MDI Gurgaon

- S. P. Jain Institute of Management and Research

- NMIMS Mumbai

- FORE School of Management, New Delhi

- IFMR GSB, Krea University

1 Comment

Pingback: FORE School of Management opens applications for PGDM FM